Formation Fi Research — taking DeFi to the next level

It often strikes me when I’m researching different projects in crypto that participants in the market have to be very well rounded to make reasonable judgements on which projects to invest in

Over the past few months I’d had to learn an incredible amount about different specific areas in “finance” and “technology” — two HUGE subjects, any one facet of which could take a lifetime to truly understand, just to stay on top of the different innovations happening in the market

So I thought for this article I would try to present my research on Formation Fi in a way that’s as simple to understand as possible!

Which is quite fitting, because although the anatomy of the project is very complex, the solution they are trying to develop is elegantly simple

What Is Formation Fi?

The End of Yield Chasing. Welcome to Cross-Chain Risk Parity Smart Farming 2.0

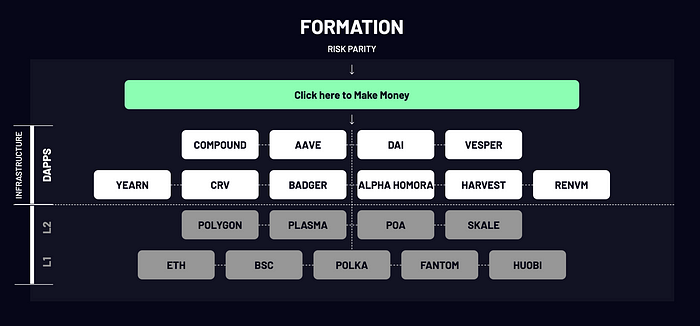

Formation Fi revolutionizes portfolio construction by introducing a risk-adjusted portfolio of decentralized open financial crypto assets in the form of algorithmically rebasing indexes, with a high degree of composability, across the major blockchain networks using the basic principles of the Risk Parity movement. The systematic architecture constructs a risk-adjusted portfolio that optimizes the return-to-risk ratio for each unit of risk, ultimately delivering a superior return over time.

Through prioritizing secular diversification, the risk parity rebalancing mechanism sorts “smart-asset allocation” by pairing counter-trend, cross-chain assets within their four classes of index coins to reduce the overall risk at a fundamental level. Formation Fi rethinks how Formation interacts with risks in DeFi and uses its data-driven insights to algorithmically construct a portfolio that will outperform through all environmental changes over time.

from https://daomaker.com/company/formation-fi

Simple, right?!

Ok, let’s break it down into simpler terms

First of all:

What is “Risk Parity”

Risk parity is a strategy laser-focused on balancing risks. Instead of only considering APY, a risk parity strategy will invest in different asset classes and use leverage to improve returns while keeping risk under control.

This strategy was championed by Ray Dalio, the legendary investor and founder of the world’s largest hedge fund, Blackwater, and was used to create and manage their infamous “all weather fund”

The point is to balance the risks across your portfolio in such a way that when the market is pulling back (or tanking!), your portfolio is sufficiently “hedged”

Some assets will go down, others will stay stable and others will go up — meaning that you are limiting your downside while giving yourself sufficient exposure to potential upside

Simply put, rather than the current “degen” strategy of the short term chasing of high yields with unlimited downside risk (which is what we’ve pretty much all been doing up until now!) it will allow you to easily create a balanced portfolio that leverages a wide range of DeFi projects and protocols in a way that allows you to optimize your profits over the long term with very little effort on your part

How Will it Work?

Using the platform, users will be able to easily create a highly diversified portfolio that is tailored to your own individual preference for risk

Rather than having to go through each protocol on various different chains and trying to figure out the risk:reward of each one, users will be able to select from an automatically recommended chain-agnostic portfolio of yield farming strategies that’s calibrated to their individual risk

The protocol will mint “index tokens” that track the underlying assets and periodically rebase to rebalance the risk

These tokens will be ERC20 which means they have the added utility of being able to be sold/swapped, used in yield farming protocols to further increase returns or used in liquidity mining pools

Which Blockchains are Supported?

Initially DeFi protocols on Ethereum, Binance Smart Chain and Huobi Eco Chain will be supported

In the future other blockchains are planned to be added such as Cardano and Polygon

Tokenomics

The $FORM token is designed to have “triple utility”

Holders of the token will receive 50% of the revenue from the protocol, with the other 50% going to the operational treasury to fund core development — up to a maximum of $1m per day, after which tokens will be burned

The total supply of $FORM is 1bn tokens, with a 2% supply expansion per year after 250k tokens have been released (although this can be changed later depending on the Dao Governance votes)

20% of the total supply will be released to users as a reward when V1 is fully released with cross-chain capabilities in the first 12 months

The remaining 80% will be released algorithmically over the ensuing 10 years

The team have stated that:

The vast majority of the proceeds from Form token sales will go into developing the technology and ecosystem development. We believe that one of our core competences will be our technology and its on-going evolution and advancement to the very top in DeFi

Full details can be found here https://medium.com/formation-fi/introducing-the-anatomy-of-form-triple-utility-3d046cd8fe64

How to Buy the $FORM Token

I have participated in a Private Round for the project through DAO Maker

Formation Fi has already completed their SHO on Dao Maker, breaking several records

📈🚀Key Highlights/ Recap:

💠Most SHO Registrations Ever on DAO Maker

💠14.4 Million DAO Power Committed

💠More Than 200X Oversubscribed

This is a positive sign for the upcoming launch of the token onto the market.

$FORM will start trading 18th June 10:00 UTC and will be available on:

KUCOIN.COM , GATE.IO, PANCAKESWAP, AND UNISWAP

Where Can I Find Out More?

Twitter https://twitter.com/formationfi

Website https://formation.fi

Telegram Chat Channel https://t.me/FormationFi

Telegram Announcement Channel @FormationFinanceAnn

Conclusion

Formation Fi has gathered a lot of attention from some major backers in a relatively short time

Their SHO was over 200x oversubscribed, they have over 42,000 people in their Telegram group and 62,000 followers on Twitter

I think the project has really hit a nerve with people

Almost anyone who was heavily into DeFi the past few months was badly hurt financially in the last few weeks

I’ve been saying to my friends for a while now that I really look forward to a time when we can start to see different segments of the crypto market acting independently

So rather than the current situation of — BTC goes down, everything else goes to hell

We can actually hedge our risks effectively and create a balanced portfolio

Well, we aren’t there yet!

So giving investors the option of investing into a risk balanced portfolio that brings together the tried and true investment strategies of traditional hedge funds and the cutting edge offerings of DeFi makes a lot of sense

Personally, I think this is an exciting development and another step forwards towards a maturer, more widely accessible crypto market